The Lebanon crisis illustrates the outcome of an inefficiently regulated market economy, shaped by long-term instant gratification of economic policies. Economy is run by corrupt institutions with ingrained crony capitalism, bureaucratic regulations and over-reliance on foriegn exchange.

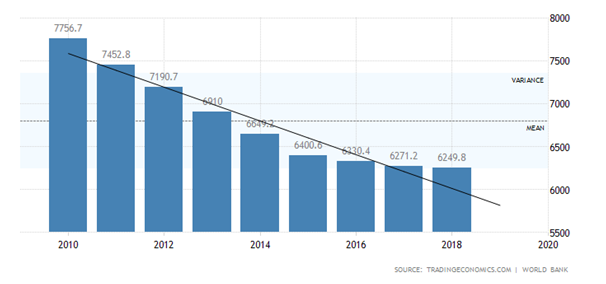

Lebanon is a free market economy in West Asia, bordered by Syria and Israel and the Mediterranean Sea, and hence, was a frequent recipient of spillovers of unrest and refugee crisis from the neighbouring countries. It is a service-sector dominated (majorly, banks and tourism) economy with a GDP of $56.9 billion─ growth rate of 0.2%, compared to 0.6% the previous year and a workforce of 2.4 million out of which 30 percent include Syrian refugees. The country relies heavily on imports (consumer goods, machinery and equipment etc) with a low dependence on exports (vegetables, non-precious metals and textiles). For years, Lebanon used foreign remittances such as transfers from non-resident Lebanese, foreign deposits and high government loans to balance the trade deficit. Lebanon exchange rate had been kept fixed at 1500 pounds per dollar which was also a fiduciary currency in Lebanon. Thus the higher demand for dollars to fixate the exchange rate, and meet the domestic demand for dollars, is levelled using foreign deposits by offering high yield rates, which had to be further funded by more deposits at even higher interest rates. These faulty policies had sustained the economy until interest payments had snowballed into heavy burden.

Figure 1: trend of GDP per capita in Lebanon

Source: Trading Economics

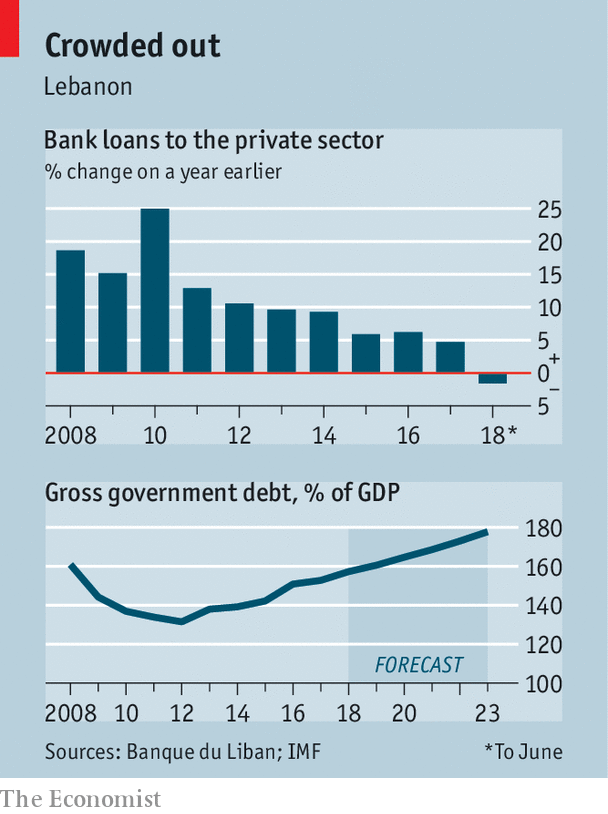

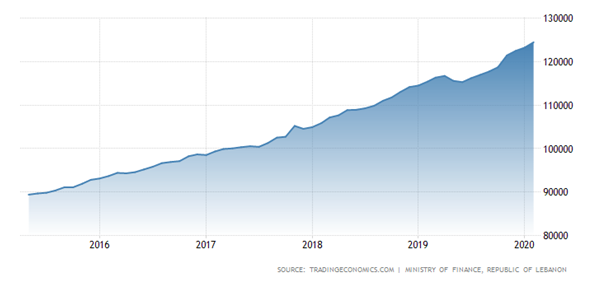

Lebanese economy is also characterized by high government debt, substantially from domestic banks, borrowed primarily for reconstruction of the economy post civil war (1975-90). Over the years, the government relied more heavily on deficit financing to meet government spending, while the weak governance and corrupt politicians moved along with unfulfilled reforms and poor economic development. There was an underprovision of basic necessities like hassle-free electricity supply, regular water and waste management. On the other hand, crony capitalism had built up, with favours laid out to private businesses which were ultimately owned by rich, exploitative politicians. The debt-to-GDP ratio peaked to 150% by 2019, with a budget deficit of 11.5% of GDP and 50% of the revenues are consumed in debt servicing. This led to an economic crisis, followed by a political crisis, and ultimately snowballed into a financial crisis, rendered vulnerable and in desperate need of foreign aid to see the day.

Evidently, though Lebanon crisis started in late 2019, it is the result of long term economic policies mismanaged by corrupt political elite; when the government proposed to tax ‘free-calls in Whatsapp’ to meet the mounting budget deficit in October 2019, protests erupted across the country, catapulting into political unrest and ousting the prime minister. Investors and citizens lost confidence in the system, and led to reducing capital inflows.

Their sovereign bonds were rated as highly risky assets (probable default), leading to interest rates as high as 15%. The political uncertainty and the liquidity crunch, led to freezing of external deposits, while the steady domestic and foreign demand for dollars persisted, leading to a shortage of USD. The banks levied restrictions (weekly quotas) on dollar withdrawals, the dollar rate spiked, depreciating the pound, and reducing the purchasing power of the pound. This had squeezed the middle and low income strata the most, draining their last pounds of savings, since their debts substantially constituted dollar repayments. Businesses relying on dollars for most part were affected as the price of imports sky-rocketed, and the oil crunch tightened until the central government stepped in to ease the situation. The condition degraded further by the onset of Coronavirus and the lockdown, which led to widespread unemployment and inflation. The World Bank estimated that 50% of Lebanese population could be pushed below the poverty line by 2020 if immediate action is not taken.

The debt of Lebanon has built up to 124464 billion LBP, i.e nearly $82 billion and the country has become the 3rd most indebted country in the world. In March 2020, Lebanon government, as a decisive step to prioritize the domestic concerns of the country and retain sustainable foreign exchange reserves in the economy, had defaulted on the Eurobond debt of $1.2 billion for the first time. The ailing economy seeks to restructure the other outstanding debts amounting to $31 billion and has been seeking advice, especially from the IMF on debt restructuring measures. There is a need for an ‘economic rescue plan’ to protect the depositors from this worst economic crisis Lebanon has faced.

Figure 2: trend of Lebanon government’s debt

Source: Trading Economics

Foreign aid from the institutions is a big responsibility, as it would demand austerity measures from the economy that had dwelled in capitalistic pleasures for so long. Though, CEDRE and foreign countries like France and UK have promised ‘soft’ loans to the Lebanese government, economists believe that external aid would be unproductive, and will become an additional debt burden on the already bleeding financial system unless government inculcates greater transparency and accountability to the public, ousting corruption and following through on long-term economic policies with commitment. Lebanon government is also seeking aid from the IMF. But this would certainly entail strict reform targets linked to the outflow of credit and hence, is very unlikely.

For the immediate future, Lebanon’s economic policies should be directed towards increasing self-reliance in the economy, with higher focus on manufacturing sectors to create employment. Financial policies to stabilize the economy are of primary concern. It is time to make up for the blunders of non-performing investments in the electricity industry. Investments on infrastructural development should be realized and substantial attention should be given to improving socio-economic conditions of the people. Construction and manufacturing industries should be supported. Actions should be taken to handle the refugee situation, and check the drain of human capital out of the country. It could be said that Lebanon’s government has a long way to go before it can regain the confidence of its people and the foreign investors in order to stabilize the economy.

Current Scenario

Covid 19 has a destructive and deleveraging impact on all the economies, and Lebanon is no exception. The economy is heavily dependent on the service sector, especially tourism, and foreign remittances. The impact of the coronavirus pandemic has been devastating on the money the expats send home, which makes up nearly 12.7% of the GDP, making Lebanon the second-most remittances dependent middle-eastern country, only behind Palestine. Amid the collapsing economy and the disruption triggered by the Covid-19 pandemic, the only certainty is the gathering pace of Lebanon’s political unrest.

REFERENCES

https://www.nytimes.com/2020/05/10/world/middleeast/lebanon-economic-crisis.html

https://www.trtworld.com/magazine/what-s-behind-lebanon-s-economic-crisis-35874

https://www.nytimes.com/2020/03/07/world/middleeast/lebanon-debt-financial-crisis.html

https://www.nytimes.com/2020/03/07/world/middleeast/lebanon-debt-financial-crisis.html

https://www.nytimes.com/2019/10/23/world/middleeast/lebanon-protests.html

DATA- https://data.worldbank.org/country/lebanon

https://www.britannica.com/place/Lebanon/Trade

https://tradingeconomics.com/lebanon/government-debt

Image Credit: Adobe Stock